Strategy

Contracting 2.0

The why, when, how -- and why not -- of value-based deals

Pricing doesn’t always cause business discontinuities -- but it’s always the double-edged sword at the center of the action, helping innovators and hobbling laggards. Discount brokers revolutionized consumer investing; discounted long-distance ultimately destroyed AT&T. Price wars bankrupted dozens of airlines -- and pricing discipline coupled with consolidation seems to have saved the survivors. While new technology enabled file sharing, Apple and Spotify wouldn’t be dominating the music industry without their pricing innovations.

The biopharmaceutical business is now being shaken by its own discontinuity, and pricing stands center stage. The key change: the transformation of the biopharmaceutical customer base from the economically unaware physician to the economically driven industrial buyer.

Like industrial purchasers everywhere, managed care organizations and at-risk health systems have different standards of evidence than do less economically sensitive stakeholders -- i.e., physicians and regulators. And like other industrial purchasers, they try to exercise their buying power to drive prices down.

This whole situation, certainly in regard to specialty drugs, is relatively new. Until Gilead Sciences Inc. launched its HCV drug Sovaldi sofosbuvir, payers had never seen a single drug that could actually turn their P&Ls red. And they had likewise rarely exercised their purchasing power in specialty until they did so in the battle over the Sovaldi follow-ons: pitting the less convenient, lower cost Viekira Pak ombitasvir/paritaprevir/ritonavir from AbbVie Inc. against Gilead’s Harvoni ledipasvir/sofosbuvir, ultimately driving the cost of these drugs below 50% of their list prices.

Until Gilead launched its HCV drug Sovaldi, payers had never seen a single drug that could actually turn their P&Ls red.

The question for biopharma: how to mitigate this new economic pressure? The answer: provide what the industrial medical purchasers require -- a differentiated medical benefit, as defined by payers, and economic predictability, at a fair price. For drug companies with real innovations, that can often mean a Contracting 2.0 -- in essence, some part of the spectrum of value-based deals. These risk-sharing plans can solve for the new purchasing equation because they can address all three variables: benefit, predictability and price. They fail when they don’t.

In any event, they’re certainly getting a lot of interest, from both payers and manufacturers. “I think these deals will be standard by 2020,” says the pharmacy director of one of the more aggressive mid-size commercial plans. And they’re good PR for drug companies: pharma CEOs have trumpeted them as market-based alternatives to price controls.

But they are hardly panaceas. Medicaid’s best price rule and the government’s interpretation of the anti-kickback statute don’t help matters. Nor do practical problems, like the cost and time required to get them negotiated in the first place (traditional volume/access-for-rebate deals are a lot cheaper to create). Indeed, unlike traditional contracts, there are no off-the-shelf templates to follow: they have to be negotiated anew, each time. One reason: different kinds of plans -- commercial, Medicare, Medicaid -- have different financial incentives: one contract structure will not fit the needs of all (see “Why One Size Doesn’t Fit All”).

Monitoring, too, can be problematic. In the first place, there is no independent referee to track and adjudicate the results. Secondly, the data to monitor isn’t always easy to find. Few plans have easy access, for example, to lab results. If the deal requires broad tracking of some blood marker, like HbA1c or LDL cholesterol, it probably won’t work.

And then there is the delicate matter of defining value. How much better is the new drug than standard of care or other competitors? Without an objective, independent assessment of clinical and economic value, both absolute and relative to existing and perhaps soon-to-come therapies, it’s difficult for plans to ascertain, let alone embrace, the possibility of what could be a major new standard of care with significant new costs. That’s one reason plans want to base decisions around evaluations from the Institute for Clinical and Economic Review (ICER) or tools like DrugAbacus from Memorial Sloan Kettering Cancer Center or RxScorecard (both powered by Real Endpoints technology and analytics).

But value-based deals can be quite useful in specific circumstances, or for specific customer groups. “We’re still experimenting,” notes Michael Sherman, the CMO of Harvard Pilgrim Health Care Inc. who’s been leading the value-based deal-making charge. “My sense is that maybe 20% of drugs are amenable to value-based deals. And I don’t think these deals will reduce overall drug spend. But if they shift dollars from drugs that don’t have much positive impact to drugs that do -- and we keep overall spending stable -- I’ll consider these deals a success.”

In short, these deals can provide an expanded tool kit for the strategically minded pharmaceutical company that knows how and when to use them.

Table: Why one size doesn’t fit all

Value-based contract deal structures need to match the incentives motivating different kinds of plans. Some plans care about medical cost-offsets; some don’t. Some care more about longer-term savings; some only shorter-term. And some leave contracting to their PBMs, who can threaten to drive up other costs if a plan insists on making exceptions, like a separate value-based deal on one specific drug.Take for example heart failure drug Entresto sacubitril/valsartan. Novartis AG (NYSE:NVS; SIX:NOVN) signed a value-based deal with the commercial business of Cigna Corp. (NYSE:CI), guaranteeing to reduce drug costs if hospitalizations didn’t drop. The insurer’s customers among employers and pension plans presumably liked the potential savings from reduced hospitalizations and certainly liked the greater choice in therapeutic options. But Cigna’s Medicare business didn’t see the same value: its prescription drug plans (PDPs) wouldn’t benefit at all from the medical cost-offsets, nor did they want to attract expensive heart-failure patients.On the other hand, a Medicare Advantage plan (MA-PD) might like an Entresto-style deal because it’s responsible for medical costs. In certain drug categories like antidiabetics, it might also like a value-based deal that guaranteed higher adherence than the competition. The reason: MA-PD plans actually get paid more money per member by improving adherence among diabetics. Still other plans might be more inclined to do value-based deals for bureaucratic reasons: many pharmacy directors who still do their own contracting need to prove their value to their bosses against PBMs who argue their huge buying power delivers bigger savings. Value-based deals present the kind of innovation that can convince management to keep a pharmacy department intact. A range of plans and their incentives are shown below. Source: Real Endpoints LLC

| Payer lines of business | Patient population | Breadth of coverage | Accountability for drug cost (%) | Ability to restrict coverage | Incentive |

| Commercial fully at-risk | <65 | Pharmacy and medical | 100% | High | Keep total costs low |

| Commercial administrative services only (ASO) | <65 | Medical (sometimes pharmacy) | 0% (most cases) | High | May profit from higher drug prices |

| Self-insured employer | <65 | Pharmacy and medical | 100% | High | Keep total costs low while attracting/retaining productive employees |

| Commercial exchanges | <65 | Pharmacy and medical | 100% | Medium | Keep total costs lower than government reimbursement |

| Medicare prescription drug plan (PDP) | ≥65 | Pharmacy only | 30% | Low | Keep pharmacy costs lower than government reimbursement |

| Medicare Advantage plan (MA-PD) | ≥65 | Pharmacy and medical | 30% | Low | Retain Star ratings; keep costs low while attracting healthy members |

| Medicaid | ≤138% poverty level | Pharmacy and medical | 0% | Medium | Keep total costs lower than government reimbursement |

| At-risk health systems | All in geography (insured and uninsured) | Pharmacy and medical | 0-100% | Medium to high | Control risk through controlling providers, labs etc. and keeping total costs low; cut middleman (e.g., PBM); exploit 340 pricing; drive dispensing fees via owned specialty pharmacy |

| Pharmacy benefit managers (PBMs) | Employees, Medicare PDP, Medicaid | Pharmacy | 0% | Medium to high (depending on lives covered) | Generic substitution; lower tiering/barriers in return for high rebates (often incentive for higher-priced drugs); drive fee income through services (e.g., use of wholly owned specialty pharmacies) |

A taxonomy

At the moment, there are really three kinds of value-based contracts that aren’t straight rebate-for-access relationships (see “Several Models”).

The easiest to structure create volume limits or incentives. A drug company might offer an additional discount, for example, if the therapeutic’s sales or adherence rate reaches a certain level, assuring the plan that greater use of the drug won’t overburden its budget while allowing the drug company to grow market share. Eli Lilly and Co.’s deal with Harvard Pilgrim on osteoporosis drug Forteo teriparatide falls into this category. Forteo’s price goes down through increased rebates if adherence to the daily injection, and therefore the drug’s prescription numbers and market share, goes up.

Value based? Sort of. But philosophically it’s closer to the traditional rebate deal: The contract simply substitutes a clinical measure important to Harvard Pilgrim -- adherence -- for prescription volume.

And like the traditional rebate deal, the adherence metrics of the Forteo arrangement are easy to track, if not perfectly reflective of adherence: medication possession ratio, or amount of drug on hand, available from Harvard Pilgrim’s PBM, MedImpact Healthcare Systems Inc.

Table: Several models

Value-based contracting comes in several models.

| Model | Definition | Example deal/impact |

| Volume limits/incentives | Drug cost capped at particular volume, or price drops if drug reaches certain adherence or lab-value goals | Unannounced deal for new oral antidiabetic. If HbA1c drops to target level for specific patient volume, total drug rebate increases. Too soon to measure, but budget effects likely limited given limits on patient population/difficulties of getting HbA1c values. |

| Indication-specific | Define drug’s value, and price or formulary status, specifically for each indication | AstraZeneca plc/Express Scripts Holding Co. on Iressa gefitinib (2016). Different prices for different lines/indications in non-small cell lung cancer (NSCLC). Impact minimal largely because usage in NSCLC is modest. |

| Performance- or outcomes-based | All/share of drug cost tied to outcomes on plan’s population | Novartis AG/Cigna Corp.’s commercial business on heart failure drug Entresto sacubitril/valsartan (2016). If reduction in CV events doesn’t meet threshold, drug rebate increases. Because most patients in Medicare, limited overall impact. |

| Amgen Inc./Harvard Pilgrim Health Care Inc. on cholesterol drug Repatha evolocumab (2017). If adherent patient has a CV event, Amgen reimburses plan and patient for entire cost of drug. Some coverage restrictions removed (e.g., no more requirement for patient to “step through” Zetia before Repatha). Too soon to predict impact. |

Indication-specific contracts

The second type of value-based deal is still quite rare -- indication-specific contracts. There are at least two flavors of these arrangements now in place. Both rely on the notion that drugs with multiple indications are more valuable for some uses than others, and both are supported far more by PBMs than by health plans. One reason: the deals don’t require tracking clinical data, to which PBMs generally don’t have access. More importantly, PBMs hope to use these deals to gain leverage in two categories in which they have very little power and in which individual drugs are used in many indications -- immunology and oncology.

The first flavor of these deals is the simplest: CVS Health Corp. now offers an indication-based formulary in which a drug may be on the list for one indication where theoretically it is more valuable, but off the list for another indication where a competitor’s been judged more valuable, perhaps by negotiating a better rebate.

The second type of deal, pioneered by Express Scripts Holding Co., puts the drug on the formulary for both indications, but at a discount that reflects a blend of different prices for each one. For example, if a drug is likely to be used 20% of the time in indication A at $10,000 and 80% of the time in indication B at $50,000, the price for the drug is $42,000. In return for accepting that discount, the drug company gets a preferred position on the formulary.

True outcomes-based contracting

The final group of value-based deals are outcomes-based contracts: the plan pays for drugs that work as promised; they pay less, or nothing, for drugs that don’t.

So far they’ve been used in two situations: to pry open access for late-to-market drugs in relatively crowded categories and to attempt to establish marketplaces for novel drugs. The jury’s still out on both.

There are a variety of flavors. Starting at the simplest: most of the European and Australian patient access schemes, in which the payer gets the first month or two of the drug for free. If the physician continues to prescribe it, presumably because it’s working, the payer pays for it. There’s rarely any objective monitoring of the drug’s efficacy -- if the doctor and patient think it’s working, fine. But in any event, the payer gets a discount.

Outcomes-based contracting can work -- not universally but nevertheless in crucial categories.

Other value-based deals do require outcomes to be measured, including several in Europe and Australia. In the U.S., Eli Lilly got to market late with its GLP-1 antidiabetic Trulicity dulaglutide. Trulicity competes with Novo Nordisk A/S’s Victoza liraglutide and AstraZeneca plc’s Bydureon exenatide, both of which have significantly greater market share. To induce plans to let physicians try Trulicity, Lilly is offering to discount Trulicity beyond current rebates if the percentage of patients on the drug with HbA1c scores at or above an agreed target is greater than patients on GLP-1 competitors. On the other hand, if Trulicity patients are doing better than those on competitors, the price goes up through a reduced rebate.

Amgen Inc. has likewise signed deals with various plans to increase the rebate for its PCSK9 inhibitor Repatha evolocumab if the drug doesn’t reduce LDL-C levels by prespecified minimums. But at least according to the plans we’ve talked with, the contracts hadn’t significantly increased prescribing of these lipid-lowering agents, at least before the March 17 release of the FOURIER outcomes data.

In part, the problem is logistical. It’s not easy to track outcomes metrics based on lab values. It’s far more straightforward to track outcomes that appear in claims forms -- like hospitalizations or physician visits. But there are also fewer drugs whose effects are reflected, at least in the short term, in such tangible financially linked results.

These early deals also have wrestled with the fact that the plans’ prior-authorization rules often remain in force despite the new agreement. Particularly for therapies that could treat potentially broad populations, plans are still very concerned about economic impact -- and they won’t budge much until they’re forced to. As a result, several of the recent outcomes-based contracts really only apply to small subsets of the eligible populations -- and that keeps the economic value to the pharmaceutical companies, and their impact on plan economics, relatively modest.

Biggest impact

But where these deals could have impact is where they satisfy the requirements of both pharmas and payers -- for example, drugs with equivocal data in specific subpopulations or perhaps the first entrant in a brand new category aiming to lock-out the competition, or a drug with new outcomes data but in a lower-risk population.

Imagine, for example, an Orphan drug with good data in one subpopulation -- and no data, but approvals, in others. Plans have realized they can be more restrictive with these difficult-to-say-no-to drugs when the evidence isn’t strong. Thanks to plan restrictions, Vertex Pharmaceuticals Inc. saw lower than expected revenues from its cystic fibrosis drug Orkambi, with lower overall efficacy than the more narrowly targeted predecessor Kalydeco. So did Sarepta Therapeutics Inc. from Exondys 51, a Duchenne muscular dystrophy drug approved with little efficacy data.

An outcomes-based contract could work for both sides in such a case: the plan pays for the drug in the subpopulation with data, and pays for it only on success in the other populations. Since the disease affects a tiny population, the monitoring would be manageable and, given the drug cost per patient, well worth the effort.

A more challenging situation: Biogen Inc.’s Spinraza nusinersen, a drug for spinal muscular atrophy (SMA) priced in the first year at $750,000 and subsequently at $375,000 annually. When it first launched, Spinraza had very good data in Type 1 SMA, and little to none in types 2 and 3. Several payers in our Real Endpoints Payers Council decided to restrict coverage to Type 1 -- and Biogen, as part of its patient assistance program, essentially gave away the drug to uncovered patients, forfeiting much of the first-year payment.

A few weeks ago, Biogen released more data about Type 3 indicating greater efficacy -- but it didn’t release the complete set. The problem for the payers: they still have less certainty about the value for Types 2 and 3 than for Type 1 -- but patient advocacy groups have more ammunition to push for coverage. And it’s working: Spinraza sales are going up faster than expected (see “One Payer’s View: Spinraza”).

Biogen, therefore, now has a lot less incentive to offer any kind of value-based deal: why go at risk if you’re going to get paid anyway?

Beyond Orphans, an outcomes-based contract could work for both sides for a drug for a much more prevalent condition -- say the PCSK9 inhibitors for dyslipidemia. Assume that the full analysis of Amgen’s FOURIER or Regeneron Pharmaceuticals Inc./Sanofi’s ODYSSEY outcomes data shows a major reduction in events for people at the highest risk -- say those with elevated LDL-C, atherosclerotic cardiovascular disease and diabetes -- but a much smaller reduction for people with just the first two symptoms. The plan and pharma company could create an outcomes based deal that makes it easier to approve prescriptions for the drugs for the lower-risk population but also measures the reduction in events over two years and then adjusts the price based on the results.

Or consider an expensive new class of specialty drugs with a set of near-to-market competitors. The first to reach the market could sign an outcomes-based contract that contains an exclusivity clause: the plan pays only on treatment success -- and in return locks out the competition. There are important caveats: both plan and drug company would be well served by the deal only if the plan feels significant pressure to make the drug available to patients; treatment success are easy to define and monitor; and the drug can prove it’s at least as good as its competition.

The point is that outcomes-based contracting can work -- not universally but nevertheless in crucial categories. We suspect that Medicaid best-price and anti-kickback rules will relax under the new administration. And as data and analytics capabilities improve -- for example, more efficient systems for tying lab values to drug use -- value-based deals will become even more common.

In the meantime, smart companies will figure out where their drugs fit in the broader framework of value-based dealmaking, define the payer segments that would benefit from them, and then start building a Contracting 2.0 action plan.

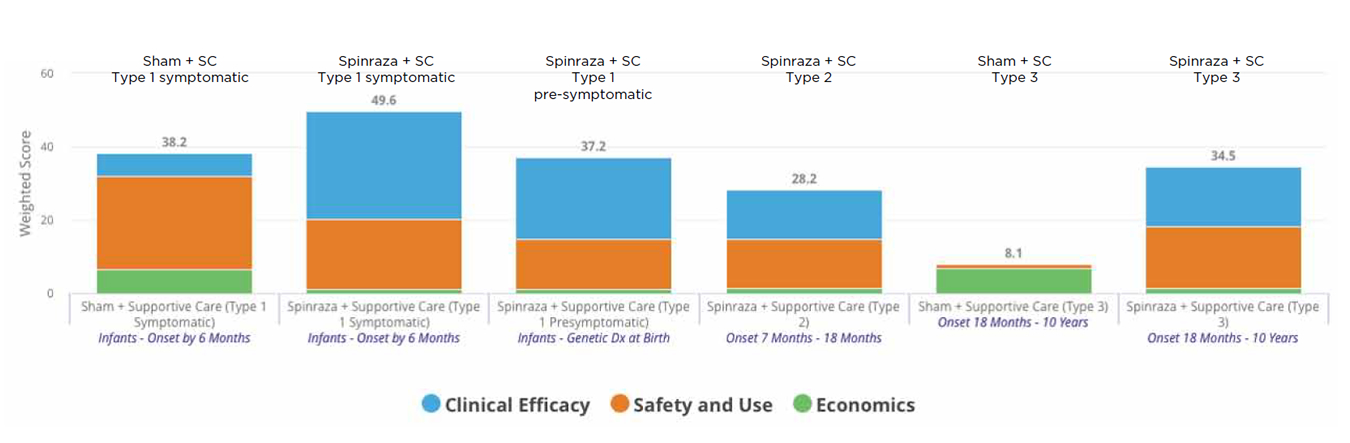

Figure: One Payer’s view: Spinraza

The chart below captures an evaluation of Spinraza nusinersen from Biogen Inc. (NASDAQ:BIIB) that one health plan did using the Real Endpoints RxScorecard tool. The higher the bars, the more value for the plan. Initially, with no evidence in Type 2 or 3 spinal muscular atrophy (SMA), the plan saw no proven value in those subpopulations - and declined coverage for them.

With new evidence released in the past few weeks, the proven value grew, particularly in Type 3 - but, since the data were limited, not to the level of Type 1. With increased physician and patient-advocacy pressure, the plan is reconsidering its coverage policy. SC = supportive care; Source: Real Endpoints’ RxScorecard

Companies and Institutions Mentioned

AbbVie Inc. (NYSE:ABBV), Chicago, Ill.

Amgen Inc. (NASDAQ:AMGN), Thousand Oaks, Calif.

AstraZeneca plc (LSE:AZN; NYSE:AZN), London, U.K.

Biogen Inc. (NASDAQ:BIIB), Cambridge, Mass.

Cigna Corp. (NYSE:CI), Bloomfield, Conn.

CVS Health Corp. (NYSE:CVS), Woonsocket, R.I.

Eli Lilly and Co. (NYSE:LLY), Indianapolis, Ind.

Express Scripts Holding Co. (NASDAQ:ESRX), St. Louis, Mo.

Gilead Sciences Inc. (NASDAQ:GILD), Foster City, Calif.

Harvard Pilgrim Health Care Inc., Boston, Mass.

Institute for Clinical and Economic Review, Boston, Mass.

Memorial Sloan Kettering Cancer Center, New York, N.Y.

Novartis AG (NYSE:NVS; SIX:NOVN), Basel, Switzerland

Novo Nordisk A/S (CSE:NOVOB; NYSE:NVO), Bagsvaerd, Denmark

Real Endpoints LLC, Westport, Conn.

Regeneron Pharmaceuticals Inc. (NASDAQ:REGN), Tarrytown, N.Y.

Sanofi (Euronext:SAN; NYSE:SNY), Paris, France

Sarepta Therapeutics Inc. (NASDAQ:SRPT), Cambridge, Mass.

Vertex Pharmaceuticals Inc. (NASDAQ:VRTX), Boston, Mass.

References

McCallister, E. “Lawyers, drugs and money.” BioCentury (2017)

McCallister, E. “Refining moment.” BioCentury (2016)

McCallister, E. “Results may vary.” BioCentury (2016)

Rhodes, J. “Paying in heart failure.” BioCentury (2015)